FORT WORTH, Texas — American Airlines Group Inc. (NASDAQ: AAL) today reported its third-quarter 2024 financial results, including:

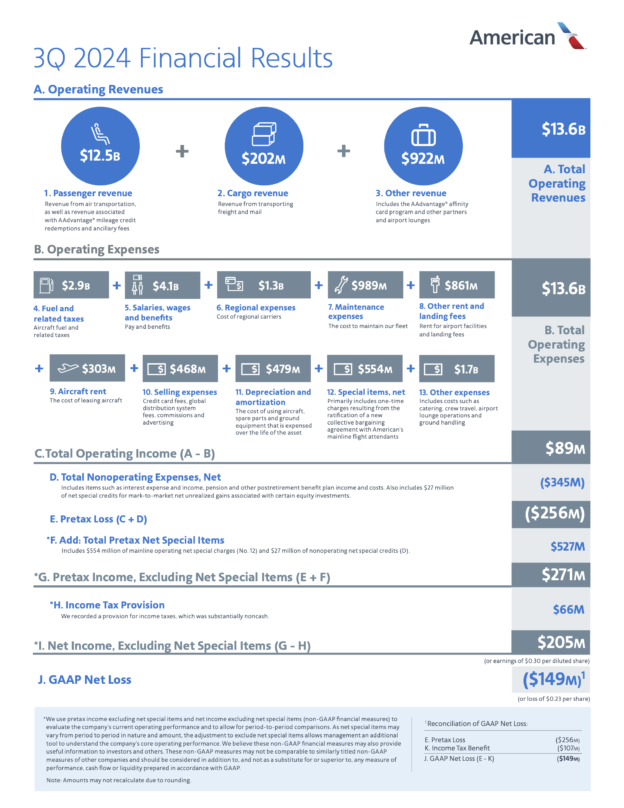

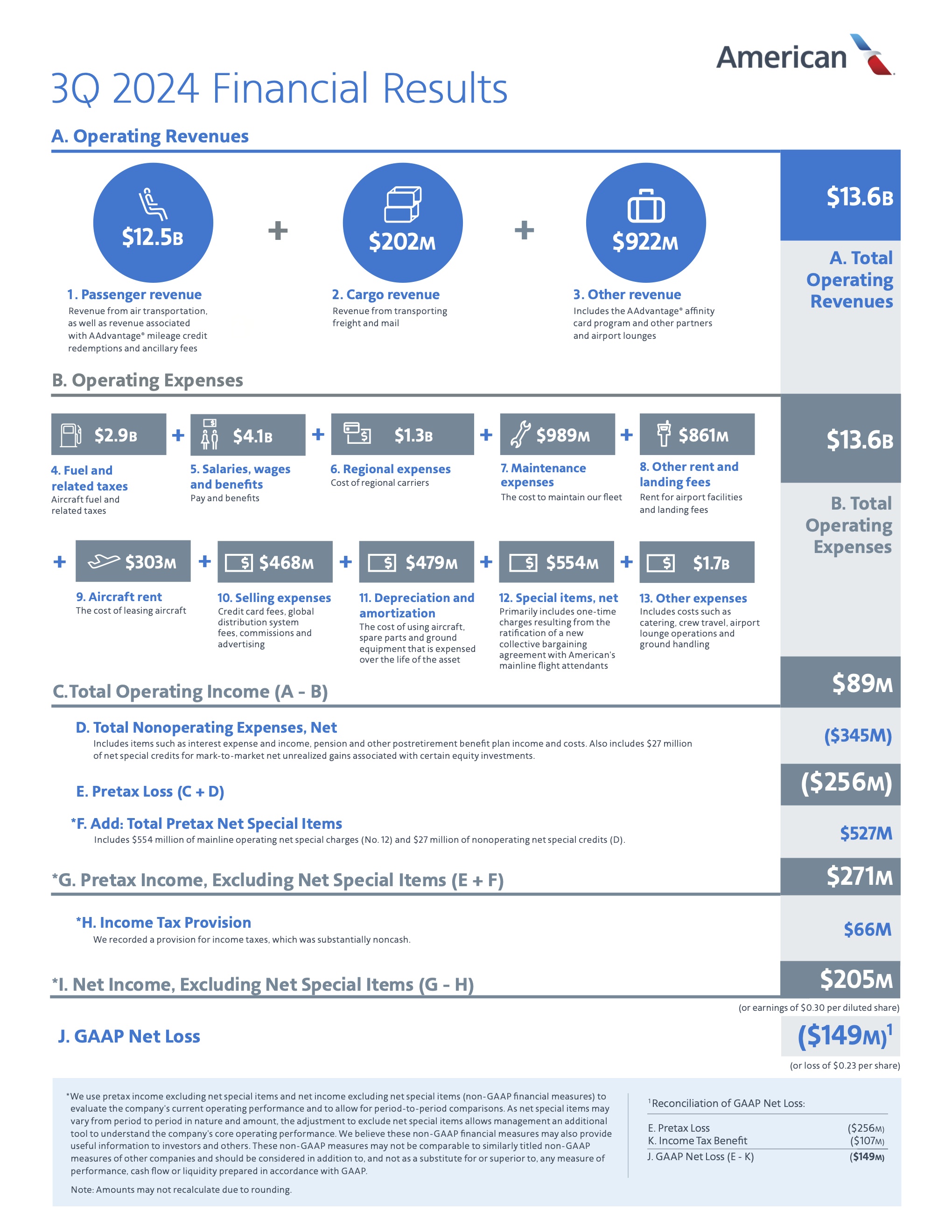

- Record third-quarter revenue of $13.6 billion.

- Third-quarter net loss of $149 million, or ($0.23) per share. Excluding net special items1, third-quarter net income of $205 million, or $0.30 per diluted share.

- Led U.S. network carriers in third-quarter completion factor.

- Ended the third quarter with $11.8 billion of total available liquidity.

- On track to reduce total debt2 from peak levels by $15 billion by year-end 2025.

- Full-year adjusted earnings per diluted share3 expected to be between $1.35 and $1.60.

“The American Airlines team continues to focus on running a reliable operation and managing costs across the airline,” said American’s CEO Robert Isom. “We have taken aggressive action to reset our sales and distribution strategy and reengage the business travel community, which we’re confident will improve our revenue performance over time. We have heard great feedback from travel agencies and corporate customers as we work to rebuild the foundation of our commercial strategy and make it easy for customers to do business with American.”

Sales and distribution strategy

American continues to evolve its sales and distribution strategy to address feedback from corporate and agency partners and regain lost share. In the third quarter, the airline renegotiated competitive contracts with a majority of the largest travel agencies and many of its top corporate customers, reintroduced Corporate Experience benefits for corporate travelers, and increased support for corporate and agency customers by adding sales account managers and sales support staff.

Operational performance

The American Airlines team demonstrated its continued resilience in the third quarter by quickly recovering from several irregular operations events, most notably the CrowdStrike outage and Hurricanes Debby and Helene. Despite the impact of these events, the American team delivered strong operational results in the third quarter, including the highest completion factor among U.S. network carriers and delivering the airline’s highest third-quarter load factor since the merger of American and US Airways in 2013.

Financial performance

American delivered earnings results ahead of prior guidance. The company produced record third-quarter revenue of $13.6 billion, an increase of 1.2% year over year. On a GAAP basis, the company produced an operating margin of 0.7% in the quarter. Excluding the impact of net special items1, the company produced an adjusted operating margin of 4.7% in the quarter.

Balance sheet and liquidity

American continued to strengthen its balance sheet in the third quarter by reducing total debt2 by approximately $360 million. The company is more than $13 billion toward its goal of reducing total debt2 by $15 billion by the end of 2025. The company ended the quarter with approximately $11.8 billion of total available liquidity, comprised of cash and short-term investments plus undrawn capacity under revolving credit and other facilities.

Guidance and investor update

Based on present demand trends, the current fuel price forecast and excluding the impact of special items, the company expects its fourth-quarter 2024 adjusted earnings per diluted share3 to be between $0.25 and $0.50. The company now expects its full-year 2024 adjusted earnings per diluted share3 to be between $1.35 and $1.60.

For additional financial forecasting detail, please refer to the company’s investor update, furnished with this press release with the SEC on Form 8-K. This filing is also available at aa.com/investorrelations.

Conference call and webcast details

The company will conduct a live audio webcast of its financial results conference call at 7:30 a.m. CT today. The call will be available to the public on a listen-only basis at aa.com/investorrelations. An archive of the webcast will be available through Nov. 24.

Notes

See the accompanying notes in the financial tables section of this press release for further explanation, including a reconciliation of all GAAP to non-GAAP financial information and the calculation of free cash flow.

- The company recognized $354 million of net special items in the third quarter after the effect of taxes, which principally included one-time charges resulting from the ratification of a new collective bargaining agreement with the company’s mainline flight attendants.

- All references to total debt include debt, finance and operating lease liabilities and pension obligations.

- Adjusted earnings per diluted share guidance excludes the impact of net special items. The company is unable to reconcile certain forward-looking information to GAAP as the nature or amount of net special items cannot be determined at this time.

Financial results

Click the button below to download the third-quarter 2024 financial results.

About American Airlines Group

As a leading global airline, American Airlines offers thousands of flights per day to more than 350 destinations in more than 60 countries. The airline is a founding member of the oneworld® alliance, whose members serve more than 900 destinations around the globe. Shares of American Airlines Group Inc. trade on Nasdaq under the ticker symbol AAL. Learn more about what’s happening at American by visiting news.aa.com and connect with American @AmericanAir and at Facebook.com/AmericanAirlines. To Care for People on Life’s Journey®.

Cautionary statement regarding forward-looking statements and information

Certain of the statements contained in this report should be considered forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth herein as well as in the company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 (especially in Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors), and other risks and uncertainties listed from time to time in the company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement.