“Thanks to the professionalism and perseverance of the United employees who have worked so hard to take care of our customers through the pandemic, our airline has reached a meaningful turning point: we’re expecting to be back to making a profit once again,” said United Airlines CEO Scott Kirby. “As we emerge from the most disruptive crisis our company has faced, we’re now focused squarely on our United Next strategy that will transform our customers’ onboard experience and help fulfill United’s incredible potential.”

|

*For purposes of this release, profitability refers to positive adjusted pre-tax income, which is a non-GAAP financial measure calculated as pre-tax income excluding special charges (credits), unrealized gains and losses on investments, net. We are not providing a target for or a reconciliation to pre-tax income, the most directly comparable GAAP measure, because we are unable to predict certain items contained in the GAAP measure without unreasonable efforts. |

Second Quarter Financial Results

- Reported second quarter 2021 capacity down 46% compared to second quarter 2019.

- Reported second quarter 2021 net loss of $0.4 billion, adjusted net loss3 of $1.3 billion.

- Reported second quarter 2021 total operating revenue of $5.5 billion, down 52% compared to second quarter 2019.

- Reported second quarter 2021 Total Revenue per Available Seat Mile (TRASM) of down 11.3% compared to second quarter 2019.

- Reported second quarter 2021 operating expenses down 42%, down 32% excluding special charges (credits)4, compared to second quarter 2019.

- Reported second quarter 2021 pre-tax margin of negative 10.3%, negative 29.2% on an adjusted5 basis.

- Reported second quarter 2021 adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) margin6 of negative 10.7%.

- Raised secured financing collateralized by substantially all of United’s network of slots, routes, and gates — made up of $4 billion in a private offering of bonds, a $5 billion term loan, and a $1.75 billion revolving credit facility. This is a first of its kind financing and the largest non-merger financing transaction in airline history.

- Reported second quarter 2021 ending available liquidity7 of approximately $23 billion.

Outlook

- Expects third quarter 2021 capacity to be down around 26% compared to third quarter 2019, up 39% quarter over quarter.

- Based on current trends, the company expects third quarter 2021 TRASM growth to be positive compared to the third quarter 2019, the first quarter of positive TRASM growth since the second quarter of 2020.

- Expects third quarter 2021 cost per available seat mile, excluding fuel, profit sharing, third-party business expenses, and special charges (CASM-ex)2 to be up approximately 17% compared to third quarter 2019 (includes a 6-point headwind largely driven by lower stage length and lower gauge of our network, including the temporary grounding of 52 Boeing Pratt & Whitney powered 777 widebody aircraft).

- Third quarter 2021 estimated fuel price of approximately $2.17 per gallon.

- Expects third quarter 2021 adjusted pre-tax income1 to be positive, the first quarter of positive adjusted pre-tax income since fourth quarter 2019. Additionally, expects fourth quarter 2021 adjusted pre-tax income1 to be positive.

- Expects 2022 cost per available seat mile, excluding fuel, profit sharing, third-party business expenses, and special charges (CASM-ex)2 to be lower than 2019.

Key Highlights

- Announced the purchase of 270 new Boeing and Airbus aircraft – the largest combined order in the airline’s history and the biggest by an individual carrier in the last decade.

- As part of “United Next” announced plans to retrofit 100% of the mainline, narrow-body fleet to transform the customer experience and create a new signature interior with a roughly 75% increase in premium seats per departure, larger overhead bins, seatback entertainment in every seat and the industry’s fastest available WiFi.

- Established a new diversity goal by striving to have 50% of students at the new United Aviate Academy be women and people of color.

- Launched the first-of-its-kind Eco-Skies Alliance℠ program through which corporate customers contributed to the purchase of approximately 3.4 million gallons of sustainable aviation fuel (SAF) in 2021.

- Entered into a commercial agreement with Denver-based aerospace company Boom Supersonic to add aircraft to United’s global fleet as well as a cooperative sustainability initiative — a move that facilitates a leap forward in returning supersonic speeds to aviation.

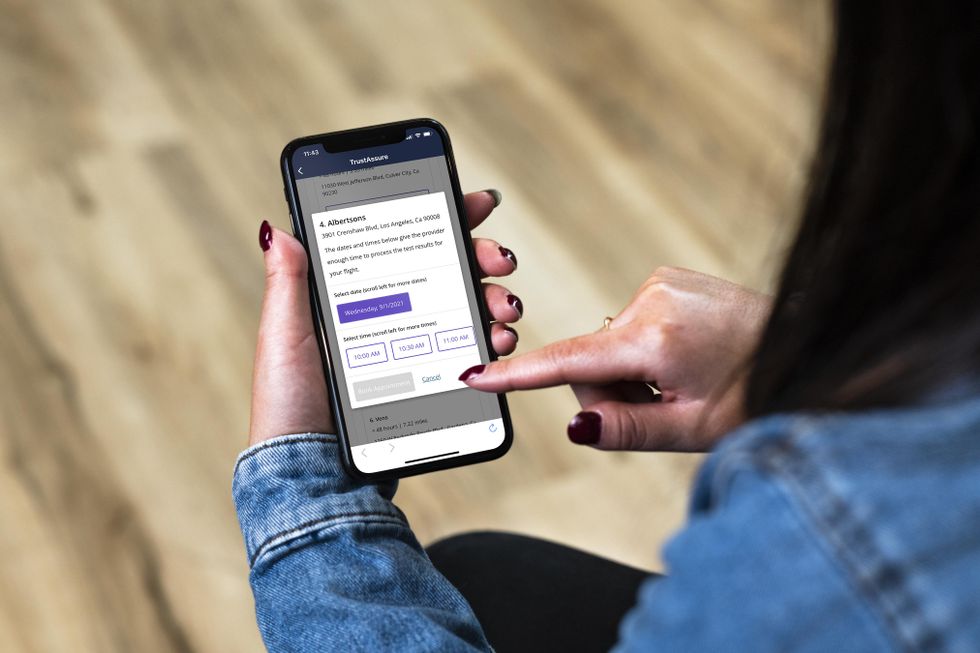

- Provided customers the ability to schedule COVID-19 tests and have results reviewed in advance through United’s industry-leading Travel-Ready Center.

- Teamed up with more than a dozen new environmental, nonprofit partners to strengthen the company’s sustainability commitment to become 100% green by reducing its greenhouse gas emissions 100% by 2050.

- Launched a new, corporate venture fund – United Airlines Ventures – which will allow the airline to continue investing in emerging companies that have the potential to influence the future of travel.

- Offered loyalty program members the chance to win free flights for a year’s worth of travel through “Your Shot to Fly” sweepstakes to encourage COVID-19 vaccinations in support of the Biden administration’s national effort to encourage people to get vaccinated.

- Announced a first-of-its-kind collaboration to use Abbott’s BinaxNOW™ COVID-19 Home Test and Abbott’s NAVICA app to help make the international travel experience more seamless.

Taking Care of Our Customers

- Introduced three new promotions that let eligible MileagePlus® Premier® members “Pick Your Path” depending on their upcoming travel plan giving members the chance to fast track their Premier status or earn bonus miles.

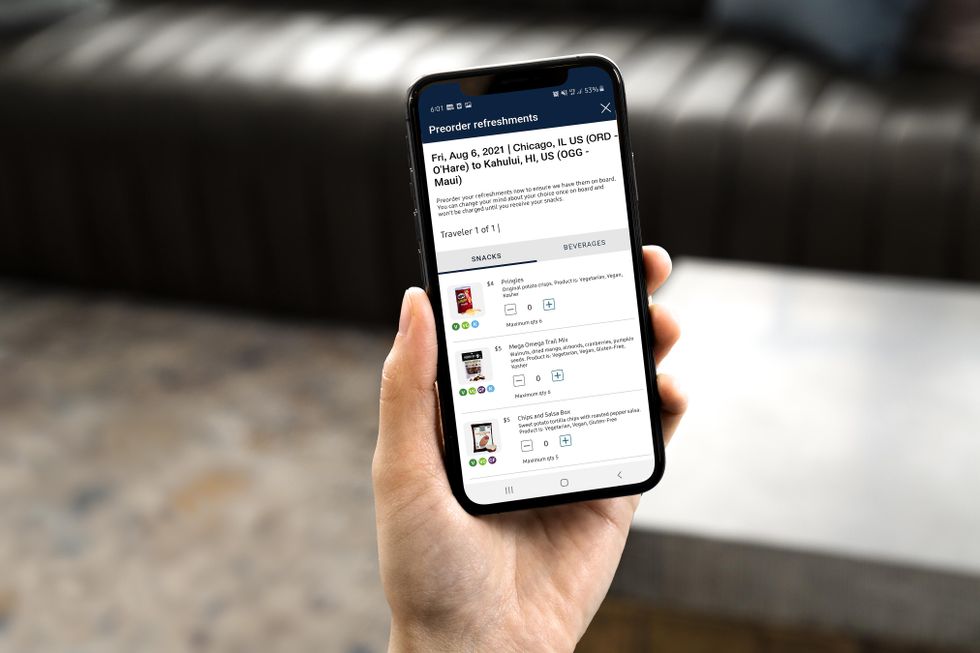

- Expanded beer, wine, and snacks to nearly all flights over two hours including new options like White Claw® Hard Seltzer, Breckenridge Brewery Juice Drop Hazy IPA, and Kona Brewing Co. Big Wave Golden Ale.

Reimagining the Route Network

- Announced seven new domestic routes and three new international routes and launched 39 domestic routes and five international routes, with 10 more international routes planned to launch in 2021.

- New route announcements included Dubrovnik, Croatia to Newark/New York; Athens, Greece to Washington, D.C.; and Reykjavik, Iceland to Chicago.

- New route launches included two new long-haul international routes from Accra, Ghana to Washington, DC, and Johannesburg, South Africa to Newark/New York, and three new routes to Hawaii including Maui/Kahului to Newark/New York, Honolulu to Orange County, and Kona to Chicago.

- Resumed nonstop service on 33 domestic routes and 14 international routes compared to the first quarter of 2021.

- Compared to March 2021, United had nonstop service in 55 more domestic and 24 more international routes in June 2021.

- Announced plans to fly roughly 80% of its full schedule in July 2021 compared to July 2019.

Assisting the Communities We Serve

- Announced a program with the Golden State Warriors to launch the Franchise Fund, a program designed to support minority-owned Bay Area small businesses.

- More than 5 million miles donated from United’s customers to charities in need of travel through United’s Miles on a Mission program.

- Over 18,200 pounds of food and beverages ($66,400 value) donated to local food banks.

- Over $326,000 raised for Airlink, World Central Kitchen, Americares, and Global Giving via CrowdRising to support COVID-19 relief efforts in India, including a $40,000 donation by United Airlines.

Additional Noteworthy Accomplishments

- Celebrated the 40th anniversary of the MileagePlus program by giving away 4 million miles to essential healthcare workers.

- Recently redesigned United mobile app was voted the Best Travel App in the 25th annual Webby Awards.

- Joined forces with Chase and Visa to offer eligible United MileagePlus Visa cardmembers the ability to earn five total miles for every dollar donated to select charities supporting the LGBTQ+ community.

- Became the first corporation in at least five years to be presented with the “Volunteer Group of the Year” award from Food Bank of the Rockies. Also, helped Food Bank of the Rockies raise the equivalent of 30,400 meals via a fundraiser.

- In the second quarter of 2021, through a combination of cargo-only flights and passenger flights, United has transported nearly 298 million pounds of freight, which includes nearly 48 million pounds of vital shipments, such as medical kits, PPE, pharmaceuticals, and medical equipment, and more than 765,000 pounds of military mail and packages.

- In the second quarter of 2021, there was an uptick in COVID-19 vaccine shipments, where United shipped 225,000 pounds of vaccines.

|

_________________________________________________________________________ |

|

1. Adjusted pre-tax income is a non-GAAP financial measure calculated as pre-tax income excluding special charges (credits), unrealized (gains) losses on investments, net. We are not providing a target for or a reconciliation to pre-tax income, the most directly comparable GAAP measure, because we are unable to predict certain items contained in the GAAP measure without unreasonable efforts. |

|

2. CASM-ex (adjusted operating expense per available seat mile) is a non-GAAP measure that excludes fuel, profit sharing, third-party business expense and special charges. We are not providing a target or reconciliation to CASM, the most directly comparable GAAP measure, because we are unable to predict certain items contained in the GAAP measure without unreasonable efforts. |

|

3. Excludes special charges (credits), unrealized (gains) losses on investments, net, debt extinguishment and modification fees and special termination benefits. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures are included in the tables accompanying this release. |

|

4. Excludes operating special charges (credits). Reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures are included in the tables accompanying this release. Second quarter 2019 operating expenses were $9.859 billion, excluding $71 million of special charges. |

|

5. Adjusted to exclude special charges (credits), unrealized (gains) losses on investments, net, debt extinguishment and modification fees and special termination benefits. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures are included in the tables accompanying this release. |

|

6. Adjusted EBITDA margin is a non-GAAP financial measure calculated as Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), excluding special charges and unrealized (gains) losses on investments, divided by total operating revenue. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures are included in the tables accompanying this release. |

|

7. Includes cash, cash equivalents, short-term investments and undrawn credit facilities. |

Earnings Call

UAL will hold a conference call to discuss second-quarter 2021 financial results as well as its financial and operational outlook for the third-quarter 2021 and beyond, on Wednesday, July 21, at 9:30 a.m. CT/10:30 a.m. ET. A live, listen-only webcast of the conference call will be available at ir.united.com.

The webcast will be available for replay within 24 hours of the conference call and then archived on the website for three months.

About United

United’s shared purpose is “Connecting People. Uniting the World.” For more information, visit united.com, follow @United on Twitter and Instagram or connect on Facebook. The common stock of United’s parent, United Airlines Holdings, Inc., is traded on the Nasdaq under the symbol “UAL”.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: Certain statements in this release, including statements regarding our outlook for the remainder of 2021, 2022 and 2023, are forward-looking and thus reflect our current expectations and beliefs with respect to certain current and future events and anticipated financial and operating performance. Such forward-looking statements are and will be subject to many risks and uncertainties relating to our operations and business environment that may cause actual results to differ materially from any future results expressed or implied in such forward-looking statements. Words such as “expects,” “will,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “goals,” “targets” and similar expressions are intended to identify forward-looking statements. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as conditional statements, statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed or assured. All forward-looking statements in this release are based upon information available to us on the date of this release. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as required by applicable law. Our actual results could differ materially from these forward-looking statements due to numerous factors including, without limitation, the following: the adverse impacts of the ongoing COVID-19 global pandemic, and possible outbreaks of another disease or similar public health threat in the future, on our business, operating results, financial condition, liquidity and near-term and long-term strategic operating plan, including possible additional adverse impacts resulting from the duration and spread of the pandemic; unfavorable economic and political conditions in the United States and globally; the highly competitive nature of the global airline industry and susceptibility of the industry to price discounting and changes in capacity; high and/or volatile fuel prices or significant disruptions in the supply of aircraft fuel; our reliance on technology and automated systems to operate our business and the impact of any significant failure or disruption of, or failure to effectively integrate and implement, the technology or systems; our reliance on third-party service providers and the impact of any significant failure of these parties to perform as expected, or interruptions in our relationships with these providers or their provision of services; adverse publicity, harm to our brand; reduced travel demand, potential tort liability and voluntary or mandatory operational restrictions as a result of an accident, catastrophe or incident involving us, our regional carriers, our codeshare partners, or another airline; terrorist attacks, international hostilities or other security events, or the fear of terrorist attacks or hostilities, even if not made directly on the airline industry; increasing privacy and data security obligations or a significant data breach; disruptions to our regional network and United Express flights provided by third-party regional carriers; the failure of our significant investments in other airlines, equipment manufacturers and other aviation industry participants to produce the returns or results we expect; further changes to the airline industry with respect to alliances and joint business arrangements or due to consolidations; changes in our network strategy or other factors outside our control resulting in less economic aircraft orders, costs related to modification or termination of aircraft orders or entry into less favorable aircraft orders, as well as any inability to accept or integrate new aircraft into our fleet as planned; our reliance on single suppliers to source a majority of our aircraft and certain parts, and the impact of any failure to obtain timely deliveries, additional equipment or support from any of these suppliers; the impacts of union disputes, employee strikes or slowdowns, and other labor-related disruptions on our operations; extended interruptions or disruptions in service at major airports where we operate; the impacts of seasonality and other factors associated with the airline industry; our failure to realize the full value of our intangible assets or our long-lived assets, causing us to record impairments; any damage to our reputation or brand image; the limitation of our ability to use our net operating loss carryforwards and certain other tax attributes to offset future taxable income for U.S. federal income tax purposes; the costs of compliance with extensive government regulation of the airline industry; costs, liabilities and risks associated with environmental regulation and climate change; the impacts of our significant amount of financial leverage from fixed obligations, the possibility we may seek material amounts of additional financial liquidity in the short-term and the impacts of insufficient liquidity on our financial condition and business; failure to comply with the covenants in the MileagePlus financing agreements, resulting in the possible acceleration of the MileagePlus indebtedness, foreclosure upon the collateral securing the MileagePlus indebtedness or the exercise of other remedies; failure to comply with financial and other covenants governing our other debt; changes in, or failure to retain, our senior management team or other key employees; current or future litigation and regulatory actions, or failure to comply with the terms of any settlement, order or arrangement relating to these actions; increases in insurance costs or inadequate insurance coverage; and other risks and uncertainties set forth under Part II, Item 1A., “Risk Factors,” of our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, as well as other risks and uncertainties set forth from time to time in the reports we file with the U.S. Securities and Exchange Commission.

-tables attached-

|

UNITED AIRLINES HOLDINGS, INC STATEMENTS OF CONSOLIDATED OPERATIONS (UNAUDITED) |

||||||||||||||||||||||||

|

Three Months Ended June 30, |

% Increase/ (Decrease) |

Six Months Ended June 30, |

% Increase/ (Decrease) |

|||||||||||||||||||||

|

(In millions, except per share data) |

2021 |

2020 |

2021 |

2020 |

||||||||||||||||||||

|

Operating revenue: |

||||||||||||||||||||||||

|

Passenger revenue |

$ |

4,366 |

$ |

681 |

541.1 |

$ |

6,682 |

$ |

7,746 |

(13.7) |

||||||||||||||

|

Cargo |

606 |

402 |

50.7 |

1,103 |

666 |

65.6 |

||||||||||||||||||

|

Other operating revenue |

499 |

392 |

27.3 |

907 |

1,042 |

(13.0) |

||||||||||||||||||

|

Total operating revenue |

5,471 |

1,475 |

270.9 |

8,692 |

9,454 |

(8.1) |

||||||||||||||||||

|

Operating expense: |

||||||||||||||||||||||||

|

Salaries and related costs |

2,276 |

2,170 |

4.9 |

4,500 |

5,125 |

(12.2) |

||||||||||||||||||

|

Aircraft fuel |

1,232 |

240 |

413.3 |

2,083 |

1,966 |

6.0 |

||||||||||||||||||

|

Depreciation and amortization |

620 |

618 |

0.3 |

1,243 |

1,233 |

0.8 |

||||||||||||||||||

|

Landing fees and other rent |

564 |

429 |

31.5 |

1,083 |

1,052 |

2.9 |

||||||||||||||||||

|

Regional capacity purchase |

547 |

388 |

41.0 |

1,026 |

1,125 |

(8.8) |

||||||||||||||||||

|

Aircraft maintenance materials and outside repairs |

302 |

110 |

174.5 |

571 |

544 |

5.0 |

||||||||||||||||||

|

Distribution expenses |

139 |

31 |

348.4 |

224 |

326 |

(31.3) |

||||||||||||||||||

|

Aircraft rent |

52 |

47 |

10.6 |

107 |

97 |

10.3 |

||||||||||||||||||

|

Special charges (credits) |

(948) |

(1,449) |

NM |

(2,325) |

(1,386) |

NM |

||||||||||||||||||

|

Other operating expenses |

957 |

528 |

81.3 |

1,831 |

1,981 |

(7.6) |

||||||||||||||||||

|

Total operating expense |

5,741 |

3,112 |

84.5 |

10,343 |

12,063 |

(14.3) |

||||||||||||||||||

|

Operating loss |

(270) |

(1,637) |

(83.5) |

(1,651) |

(2,609) |

(36.7) |

||||||||||||||||||

|

Nonoperating income (expense): |

||||||||||||||||||||||||

|

Interest expense |

(426) |

(196) |

117.3 |

(779) |

(367) |

112.3 |

||||||||||||||||||

|

Interest capitalized |

22 |

17 |

29.4 |

39 |

38 |

2.6 |

||||||||||||||||||

|

Interest income |

12 |

11 |

9.1 |

19 |

37 |

(48.6) |

||||||||||||||||||

|

Unrealized gains (losses) on investments, net |

147 |

9 |

NM |

125 |

(310) |

NM |

||||||||||||||||||

|

Miscellaneous, net |

(49) |

(207) |

(76.3) |

(68) |

(906) |

(92.5) |

||||||||||||||||||

|

Total nonoperating expense, net |

(294) |

(366) |

(19.7) |

(664) |

(1,508) |

(56.0) |

||||||||||||||||||

|

Loss before income tax benefit |

(564) |

(2,003) |

(71.8) |

(2,315) |

(4,117) |

(43.8) |

||||||||||||||||||

|

Income tax benefit |

(130) |

(376) |

(65.4) |

(524) |

(786) |

(33.3) |

||||||||||||||||||

|

Net loss |

$ |

(434) |

$ |

(1,627) |

(73.3) |

$ |

(1,791) |

$ |

(3,331) |

(46.2) |

||||||||||||||

|

Diluted loss per share |

$ |

(1.34) |

$ |

(5.79) |

(76.9) |

$ |

(5.60) |

$ |

(12.59) |

(55.5) |

||||||||||||||

|

Diluted weighted average shares |

323.6 |

280.7 |

15.3 |

320.1 |

264.6 |

21.0 |

||||||||||||||||||

|

NM Not meaningful |

||||||||||||||||||||||||

|

UNITED AIRLINES HOLDINGS, INC. PASSENGER REVENUE INFORMATION AND STATISTICS |

|||||||||||||||||||||

|

Passenger revenue information is as follows (in millions, except for percentage changes): |

|||||||||||||||||||||

|

2Q 2021 Passenger Revenue |

Passenger Revenue vs. 2Q 2020 |

PRASM vs. |

PRASM vs. |

Yield vs. |

Available Seat Miles vs. 2Q 2020 |

Available Seat Miles vs. 2Q 2019 |

2Q 2021 |

2Q 2021 |

|||||||||||||

|

Domestic |

$ |

3,288 |

506.6% |

57.0% |

(15.7%) |

(32.7%) |

286.1% |

(40.4%) |

24,717 |

20,587 |

|||||||||||

|

Atlantic |

323 |

466.7% |

14.4% |

(61.0%) |

(35.2%) |

396.3% |

(57.0%) |

6,065 |

2,827 |

||||||||||||

|

Pacific |

132 |

288.2% |

42.7% |

(48.8%) |

13.8% |

172.1% |

(77.3%) |

2,438 |

587 |

||||||||||||

|

Latin America |

623 |

1,197.9% |

(10.1%) |

(23.4%) |

(44.8%) |

1,343.1% |

(7.2%) |

6,393 |

4,513 |

||||||||||||

|

International |

1,078 |

675.5% |

33.3% |

(41.6%) |

(32.8%) |

481.6% |

(53.1%) |

14,896 |

7,927 |

||||||||||||

|

Consolidated |

$ |

4,366 |

541.1% |

45.0% |

(23.0%) |

(33.2%) |

342.0% |

(45.9%) |

39,613 |

28,514 |

|||||||||||

|

Select operating statistics are as follows: |

||||||||||||||||||||||||

|

Three Months Ended June 30, |

% Increase/ (Decrease) |

Six Months Ended June 30, |

% Increase/ (Decrease) |

|||||||||||||||||||||

|

2021 |

2020 |

2021 |

2020 |

|||||||||||||||||||||

|

Passengers (thousands) |

23,909 |

2,813 |

749.9 |

38,583 |

33,172 |

16.3 |

||||||||||||||||||

|

Revenue passenger miles (millions) |

28,514 |

2,970 |

860.1 |

45,762 |

46,199 |

(0.9) |

||||||||||||||||||

|

Available seat miles (millions) |

39,613 |

8,963 |

342.0 |

69,983 |

69,901 |

0.1 |

||||||||||||||||||

|

Passenger load factor: |

||||||||||||||||||||||||

|

Consolidated |

72.0 |

% |

33.1 |

% |

38.9 |

pts. |

65.4 |

% |

66.1 |

% |

(0.7) |

pts. |

||||||||||||

|

Domestic |

83.3 |

% |

35.7 |

% |

47.6 |

pts. |

75.4 |

% |

65.6 |

% |

9.8 |

pts. |

||||||||||||

|

International |

53.2 |

% |

26.8 |

% |

26.4 |

pts. |

48.8 |

% |

66.8 |

% |

(18.0) |

pts. |

||||||||||||

|

Passenger revenue per available seat mile (cents) |

11.02 |

7.60 |

45.0 |

9.55 |

11.08 |

(13.8) |

||||||||||||||||||

|

Total revenue per available seat mile (cents) |

13.81 |

16.46 |

(16.1) |

12.42 |

13.52 |

(8.1) |

||||||||||||||||||

|

Average yield per revenue passenger mile (cents) |

15.31 |

22.93 |

(33.2) |

14.60 |

16.77 |

(12.9) |

||||||||||||||||||

|

Cargo revenue ton miles (millions) |

892 |

496 |

79.8 |

1,657 |

1,191 |

39.1 |

||||||||||||||||||

|

Aircraft in fleet at end of period |

1,315 |

1,307 |

0.6 |

1,315 |

1,307 |

0.6 |

||||||||||||||||||

|

Average stage length (miles) |

1,309 |

1,075 |

21.8 |

1,297 |

1,347 |

(3.7) |

||||||||||||||||||

|

Employee headcount, as of June 30 (in thousands) (a) |

84.4 |

91.8 |

(8.1) |

84.4 |

91.8 |

(8.1) |

||||||||||||||||||

|

Average aircraft fuel price per gallon |

$ |

1.97 |

$ |

1.18 |

66.9 |

$ |

1.87 |

$ |

1.76 |

6.3 |

||||||||||||||

|

Fuel gallons consumed (millions) |

625 |

204 |

206.4 |

1,115 |

1,114 |

0.1 |

||||||||||||||||||

|

(a) The 2021 employee headcount includes approximately 4,500 employees who participated in the Company’s voluntary leave programs |

||||||||||||||||||||||||

|

Note: See Part II, Item 6, Selected Financial Data, of UAL’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, for definitions of these statistics. |

UNITED AIRLINES HOLDINGS, INC.

NON-GAAP FINANCIAL RECONCILIATION

UAL evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (GAAP) and Non-GAAP financial measures, including adjusted earnings before interest, taxes, depreciation and amortization (adjusted EBITDA), adjusted operating income (loss), adjusted operating margin, adjusted pre-tax income (loss), adjusted pre-tax margin, adjusted net income (loss), adjusted diluted earnings (loss) per share, CASM, excluding special charges, third-party business expenses, fuel, and profit sharing (CASM-ex), and operating expenses excluding special charges, among others. UAL believes that adjusting for special charges (credits), nonoperating debt extinguishment and modification fees, nonoperating special termination benefits and settlement losses and nonoperating credit losses is useful to investors because these items are not indicative of UAL’s ongoing performance. UAL believes that adjusting for unrealized (gains) losses on investments, net is useful to investors because those unrealized gains or losses may not ultimately be realized on a cash basis.

CASM is a common metric used in the airline industry to measure an airline’s cost structure and efficiency. UAL reports CASM excluding special charges (credits), third-party business expenses, fuel and profit sharing. UAL believes that adjusting for special charges (credits) is useful to investors because special charges (credits) are not indicative of UAL’s ongoing performance. UAL also believes that excluding third-party business expenses, such as maintenance, ground handling and catering services for third parties, provides more meaningful disclosure because these expenses are not directly related to UAL’s core business. UAL also believes that excluding fuel costs from certain measures is useful to investors because it provides an additional measure of management’s performance excluding the effects of a significant cost item over which management has limited influence. UAL excludes profit sharing because this exclusion allows investors to better understand and analyze our operating cost performance and provides a more meaningful comparison of our core operating costs to the airline industry.

Reconciliations of reported non-GAAP financial measures to the most directly comparable GAAP financial measures are included below.

|

Three Months Ended June 30, |

Six Months Ended June 30, |

Year Ended |

|||||||||||||||||||

|

2021 |

2020 |

2019 |

2021 |

2020 |

2019 |

2019 |

|||||||||||||||

|

CASM (cents) |

|||||||||||||||||||||

|

Cost per available seat mile (CASM) (GAAP) |

14.49 |

34.72 |

13.56 |

14.78 |

17.26 |

13.70 |

13.67 |

||||||||||||||

|

Special charges (credits) |

(2.40) |

(16.17) |

0.10 |

(3.32) |

(1.98) |

0.07 |

0.09 |

||||||||||||||

|

Third-party business expenses |

0.08 |

0.65 |

0.05 |

0.08 |

0.15 |

0.05 |

0.06 |

||||||||||||||

|

Fuel expense |

3.11 |

2.68 |

3.26 |

2.97 |

2.81 |

3.17 |

3.14 |

||||||||||||||

|

Profit sharing |

— |

— |

0.22 |

— |

— |

0.14 |

0.17 |

||||||||||||||

|

CASM, excluding special charges (credits), third-party business |

13.70 |

47.56 |

9.93 |

15.05 |

16.28 |

10.27 |

10.21 |

||||||||||||||

|

Adjusted EBITDA |

June |

Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||||||||||

|

2021 |

2021 |

2020 |

2019 |

2021 |

2020 |

2019 |

|||||||||||||||||||||

|

Net income (loss) |

$ |

183 |

$ |

(434) |

$ |

(1,627) |

$ |

1,052 |

$ |

(1,791) |

$ |

(3,331) |

1,344 |

||||||||||||||

|

Adjusted for: |

|||||||||||||||||||||||||||

|

Depreciation and amortization |

207 |

620 |

618 |

560 |

1,243 |

1,233 |

1,107 |

||||||||||||||||||||

|

Interest expense, net of capitalized interest and interest income |

133 |

392 |

168 |

132 |

721 |

292 |

269 |

||||||||||||||||||||

|

Income tax expense (benefit) |

41 |

(130) |

(376) |

302 |

(524) |

(786) |

377 |

||||||||||||||||||||

|

Special charges (credits) |

(245) |

(948) |

(1,449) |

71 |

(2,325) |

(1,386) |

89 |

||||||||||||||||||||

|

Nonoperating unrealized (gains) losses on investments, net |

(107) |

(147) |

(9) |

(34) |

(125) |

310 |

(51) |

||||||||||||||||||||

|

Nonoperating debt extinguishment and modification fees |

— |

62 |

— |

— |

62 |

— |

— |

||||||||||||||||||||

|

Nonoperating special termination benefits and settlement losses |

— |

— |

231 |

— |

46 |

231 |

— |

||||||||||||||||||||

|

Nonoperating credit loss on BRW term loan and guarantee |

— |

— |

— |

— |

— |

697 |

— |

||||||||||||||||||||

|

Adjusted EBITDA, excluding operating and |

$ |

212 |

$ |

(585) |

$ |

(2,444) |

$ |

2,083 |

$ |

(2,693) |

$ |

(2,740) |

$ |

3,135 |

|||||||||||||

|

Adjusted EBITDA margin |

9.2 |

% |

(10.7) |

% |

(165.7) |

% |

18.3 |

% |

(31.0) |

% |

(29.0) |

% |

14.9 |

% |

|||||||||||||

|

NM Not Meaningful |

|||||||||||||||||||||||||||

UNITED AIRLINES HOLDINGS, INC.

NON-GAAP FINANCIAL RECONCILIATION (Continued)

UAL believes that adjusting capital expenditures for assets acquired through the issuance of debt, finance leases and other financial liabilities is useful to investors in order to appropriately reflect the total amounts spent on capital expenditures. UAL also believes that adjusting net cash provided by operating activities for capital expenditures, adjusted capital expenditures, and aircraft operating lease additions is useful to allow investors to evaluate the company’s ability to generate cash that is available for debt service or general corporate initiatives.

|

Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||

|

Capital Expenditures (in millions) |

2021 |

2020 |

2021 |

2020 |

|||||||||||

|

Capital expenditures, net of flight equipment purchase deposit returns (GAAP) |

$ |

861 |

$ |

39 |

$ |

1,305 |

$ |

1,998 |

|||||||

|

Property and equipment acquired through the issuance of debt, finance leases, |

252 |

498 |

761 |

626 |

|||||||||||

|

Adjustment to property and equipment acquired through other financial |

26 |

(53) |

(14) |

(53) |

|||||||||||

|

Adjusted capital expenditures (Non-GAAP) |

$ |

1,139 |

$ |

484 |

$ |

2,052 |

$ |

2,571 |

|||||||

|

Free Cash Flow (in millions) |

|||||||||||||||

|

Net cash provided by (used in) operating activities (GAAP) |

$ |

2,675 |

$ |

(130) |

$ |

3,122 |

$ |

(67) |

|||||||

|

Less capital expenditures, net of flight equipment purchase deposit returns |

861 |

39 |

1,305 |

1,998 |

|||||||||||

|

Free cash flow, net of financings (Non-GAAP) |

$ |

1,814 |

$ |

(169) |

$ |

1,817 |

$ |

(2,065) |

|||||||

|

Net cash provided by (used in) operating activities (GAAP) |

$ |

2,675 |

$ |

(130) |

$ |

3,122 |

$ |

(67) |

|||||||

|

Less adjusted capital expenditures (Non-GAAP) |

1,139 |

484 |

2,052 |

2,571 |

|||||||||||

|

Less aircraft operating lease additions |

33 |

12 |

175 |

33 |

|||||||||||

|

Free cash flow (Non-GAAP) |

$ |

1,503 |

$ |

(626) |

$ |

895 |

$ |

(2,671) |

|||||||

|

(a) United entered into agreements with third parties to finance through sale and leaseback transactions new Boeing model 787 aircraft and Boeing model 737 MAX aircraft subject to purchase agreements between United and Boeing. In connection with the delivery of each aircraft from Boeing, United assigned its right to purchase such aircraft to the buyer, and simultaneous with the buyer’s purchase from Boeing, United entered into a long-term lease for such aircraft with the buyer as lessor. Eleven Boeing model aircraft were delivered in 2021 under these transactions (and each is presently subject to a long-term lease to United). Upon delivery, the company accounted for the aircraft, which have a repurchase option at a price other than fair value, as part of Flight equipment on the company’s balance sheet and the related obligation as Other current liabilities and Other financial liabilities from sale-leasebacks (noncurrent) since they do not qualify for sale recognition. If the repurchase option is not exercised, these aircraft will be accounted for as leased assets at the time of the option expiration and the related assets and liabilities will be adjusted to the present value of the remaining lease payments at that time. This adjustment reflects the difference between the recorded amounts and the present value of future lease payments at inception. |

|||||||||||||||

|

UNITED AIRLINES HOLDINGS, INC. NON-GAAP FINANCIAL RECONCILIATION (Continued) |

|||||||||||||||||||||||||||||

|

Three Months Ended June 30, |

Increase/ (Decrease) |

% Increase/ (Decrease) |

Six Months Ended June 30, |

Increase/ (Decrease) |

% Increase/ (Decrease) |

||||||||||||||||||||||||

|

(in millions) |

2021 |

2020 |

2021 |

2020 |

|||||||||||||||||||||||||

|

Operating expenses (GAAP) |

$ |

5,741 |

$ |

3,112 |

$ |

2,629 |

84.5 |

$ |

10,343 |

$ |

12,063 |

$ |

(1,720) |

(14.3) |

|||||||||||||||

|

Special charges (credits) |

(948) |

(1,449) |

(501) |

NM |

(2,325) |

(1,386) |

939 |

NM |

|||||||||||||||||||||

|

Operating expenses, excluding special charges |

6,689 |

4,561 |

2,128 |

46.7 |

12,668 |

13,449 |

(781) |

(5.8) |

|||||||||||||||||||||

|

Adjusted to exclude: |

|||||||||||||||||||||||||||||

|

Third-party business expenses |

30 |

58 |

(28) |

(48.3) |

56 |

102 |

(46) |

(45.1) |

|||||||||||||||||||||

|

Fuel expense |

1,232 |

240 |

992 |

413.3 |

2,083 |

1,966 |

117 |

6.0 |

|||||||||||||||||||||

|

Adjusted operating expenses (Non-GAAP) |

$ |

5,427 |

$ |

4,263 |

$ |

1,164 |

27.3 |

$ |

10,529 |

$ |

11,381 |

$ |

(852) |

(7.5) |

|||||||||||||||

|

Operating loss (GAAP) |

$ |

(270) |

$ |

(1,637) |

$ |

(1,367) |

(83.5) |

$ |

(1,651) |

$ |

(2,609) |

(958) |

(36.7) |

||||||||||||||||

|

Adjusted to exclude: |

|||||||||||||||||||||||||||||

|

Special charges (credits) |

(948) |

(1,449) |

$ |

(501) |

NM |

(2,325) |

(1,386) |

939 |

NM |

||||||||||||||||||||

|

Adjusted operating loss (Non-GAAP) |

$ |

(1,218) |

$ |

(3,086) |

$ |

(1,868) |

(60.5) |

$ |

(3,976) |

$ |

(3,995) |

$ |

(19) |

(0.5) |

|||||||||||||||

|

Operating margin |

(4.9) |

% |

(111.0) |

% |

106.1 |

pts. |

(19.0) |

% |

(27.6) |

% |

8.6 |

pts. |

|||||||||||||||||

|

Adjusted operating margin (Non-GAAP) |

(22.3) |

% |

(209.2) |

% |

186.9 |

pts. |

(45.7) |

% |

(42.3) |

% |

(3.4) |

pts. |

|||||||||||||||||

|

Pre-tax loss (GAAP) |

$ |

(564) |

$ |

(2,003) |

$ |

(1,439) |

(71.8) |

$ |

(2,315) |

$ |

(4,117) |

$ |

(1,802) |

(43.8) |

|||||||||||||||

|

Adjusted to exclude: |

|||||||||||||||||||||||||||||

|

Special charges (credits) |

(948) |

(1,449) |

(501) |

NM |

(2,325) |

(1,386) |

939 |

NM |

|||||||||||||||||||||

|

Unrealized (gains) losses on investments, net |

(147) |

(9) |

138 |

NM |

(125) |

310 |

(435) |

NM |

|||||||||||||||||||||

|

Debt extinguishment and modification fees |

62 |

— |

62 |

NM |

62 |

— |

62 |

NM |

|||||||||||||||||||||

|

Special termination benefits |

— |

231 |

(231) |

NM |

46 |

231 |

(185) |

NM |

|||||||||||||||||||||

|

Credit loss on BRW term loan and guarantee |

— |

— |

— |

NM |

— |

697 |

(697) |

NM |

|||||||||||||||||||||

|

Adjusted pre-tax loss (Non-GAAP) |

$ |

(1,597) |

$ |

(3,230) |

$ |

(1,633) |

(50.6) |

$ |

(4,657) |

$ |

(4,265) |

$ |

392 |

9.2 |

|||||||||||||||

|

Pre-tax margin |

(10.3) |

% |

(135.8) |

% |

125.5 |

pts. |

(26.6) |

% |

(43.5) |

% |

16.9 |

pts. |

|||||||||||||||||

|

Adjusted pre-tax margin (Non-GAAP) |

(29.2) |

% |

(219.0) |

% |

189.8 |

pts. |

(53.6) |

% |

(45.1) |

% |

(8.5) |

pts. |

|||||||||||||||||

|

Net loss (GAAP) |

$ |

(434) |

$ |

(1,627) |

$ |

(1,193) |

(73.3) |

$ |

(1,791) |

$ |

(3,331) |

$ |

(1,540) |

(46.2) |

|||||||||||||||

|

Adjusted to exclude: |

|||||||||||||||||||||||||||||

|

Special charges (credits) |

(948) |

(1,449) |

(501) |

NM |

(2,325) |

(1,386) |

939 |

NM |

|||||||||||||||||||||

|

Unrealized (gains) losses on investments, net |

(147) |

(9) |

138 |

NM |

(125) |

310 |

(435) |

NM |

|||||||||||||||||||||

|

Debt extinguishment and modification fees |

62 |

— |

62 |

NM |

62 |

— |

62 |

NM |

|||||||||||||||||||||

|

Special termination benefits |

— |

231 |

(231) |

NM |

46 |

231 |

(185) |

NM |

|||||||||||||||||||||

|

Credit loss on BRW term loan and guarantee |

— |

— |

— |

NM |

— |

697 |

(697) |

NM |

|||||||||||||||||||||

|

Income tax expense related to adjustments |

203 |

241 |

(38) |

NM |

494 |

227 |

267 |

NM |

|||||||||||||||||||||

|

Adjusted net loss (Non-GAAP) |

$ |

(1,264) |

$ |

(2,613) |

$ |

(1,349) |

(51.6) |

$ |

(3,639) |

$ |

(3,252) |

$ |

387 |

11.9 |

|||||||||||||||

|

Diluted loss per share (GAAP) |

$ |

(1.34) |

$ |

(5.79) |

$ |

(4.45) |

(76.9) |

$ |

(5.60) |

$ |

(12.59) |

$ |

(6.99) |

(55.5) |

|||||||||||||||

|

Adjusted to exclude: |

|||||||||||||||||||||||||||||

|

Special charges (credits) |

(2.93) |

(5.17) |

(2.24) |

NM |

(7.26) |

(5.24) |

$ |

2.02 |

NM |

||||||||||||||||||||

|

Unrealized (gains) losses on investments, net |

(0.46) |

(0.03) |

0.43 |

NM |

(0.39) |

1.17 |

(1.56) |

NM |

|||||||||||||||||||||

|

Debt extinguishment and modification fees |

0.19 |

— |

0.19 |

NM |

0.19 |

— |

0.19 |

NM |

|||||||||||||||||||||

|

Special termination benefits |

— |

0.82 |

(0.82) |

NM |

0.15 |

0.87 |

(0.72) |

NM |

|||||||||||||||||||||

|

Credit loss on BRW term loan and guarantee |

— |

— |

— |

NM |

— |

2.64 |

(2.64) |

NM |

|||||||||||||||||||||

|

Income tax expense (benefit) related to |

0.63 |

0.86 |

(0.23) |

NM |

1.54 |

0.86 |

0.68 |

NM |

|||||||||||||||||||||

|

Adjusted diluted loss per share (Non-GAAP) |

$ |

(3.91) |

$ |

(9.31) |

$ |

(5.40) |

(58.0) |

$ |

(11.37) |

$ |

(12.29) |

$ |

(0.92) |

(7.5) |

|||||||||||||||

|

NM Not Meaningful |

|

UNITED AIRLINES HOLDINGS, INC CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

|||||||

|

(In millions) |

June 30, 2021 |

December 31, 2020 |

|||||

|

ASSETS |

|||||||

|

Current assets: |

|||||||

|

Cash and cash equivalents |

$ |

20,838 |

$ |

11,269 |

|||

|

Short-term investments |

230 |

414 |

|||||

|

Restricted cash |

254 |

255 |

|||||

|

Receivables, less allowance for credit losses (2021 — $71; 2020 — $78) |

1,793 |

1,295 |

|||||

|

Aircraft fuel, spare parts and supplies, less obsolescence allowance (2021 — $518; 2020 — $478) |

912 |

932 |

|||||

|

Prepaid expenses and other |

646 |

635 |

|||||

|

Total current assets |

24,673 |

14,800 |

|||||

|

Total operating property and equipment, net |

32,331 |

31,466 |

|||||

|

Operating lease right-of-use assets |

4,421 |

4,537 |

|||||

|

Other assets: |

|||||||

|

Goodwill |

4,527 |

4,527 |

|||||

|

Intangibles, less accumulated amortization (2021 — $1,519; 2020 — $1,495) |

2,827 |

2,838 |

|||||

|

Restricted cash |

216 |

218 |

|||||

|

Deferred income taxes |

647 |

131 |

|||||

|

Investments in affiliates and other, less allowance for credit losses (2021 — $606; 2020 — $522) |

1,407 |

1,031 |

|||||

|

Total other assets |

9,624 |

8,745 |

|||||

|

Total assets |

$ |

71,049 |

$ |

59,548 |

|||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|||||||

|

Current liabilities: |

|||||||

|

Accounts payable |

$ |

2,218 |

$ |

1,595 |

|||

|

Accrued salaries and benefits |

2,228 |

1,960 |

|||||

|

Advance ticket sales |

6,960 |

4,833 |

|||||

|

Frequent flyer deferred revenue |

2,099 |

908 |

|||||

|

Current maturities of long-term debt |

1,881 |

1,911 |

|||||

|

Current maturities of operating leases |

583 |

612 |

|||||

|

Current maturities of finance leases |

144 |

182 |

|||||

|

Payroll Support Program deferred credit |

1,132 |

— |

|||||

|

Other |

819 |

724 |

|||||

|

Total current liabilities |

18,064 |

12,725 |

|||||

|

Long-term liabilities and deferred credits: |

|||||||

|

Long-term debt |

32,303 |

24,836 |

|||||

|

Long-term obligations under operating leases |

4,920 |

4,986 |

|||||

|

Long-term obligations under finance leases |

250 |

224 |

|||||

|

Frequent flyer deferred revenue |

4,086 |

5,067 |

|||||

|

Pension liability |

2,501 |

2,460 |

|||||

|

Postretirement benefit liability |

988 |

994 |

|||||

|

Other financial liabilities from sale-leasebacks |

1,683 |

1,140 |

|||||

|

Other |

1,350 |

1,156 |

|||||

|

Total long-term liabilities and deferred credits |

48,081 |

40,863 |

|||||

|

Total stockholders’ equity |

4,904 |

5,960 |

|||||

|

Total liabilities and stockholders’ equity |

$ |

71,049 |

$ |

59,548 |

|||

|

UNITED AIRLINES HOLDINGS, INC. CONDENSED STATEMENTS OF CONSOLIDATED CASH FLOWS (UNAUDITED) |

|||||||

|

(In millions) |

Six Months Ended June 30, |

||||||

|

2021 |

2020 |

||||||

|

Cash Flows from Operating Activities: |

|||||||

|

Net cash provided by (used in) operating activities |

$ |

3,122 |

$ |

(67) |

|||

|

Cash Flows from Investing Activities: |

|||||||

|

Capital expenditures, net of flight equipment purchase deposit returns |

(1,305) |

(1,998) |

|||||

|

Purchases of short-term investments |

— |

(550) |

|||||

|

Proceeds from sale of short-term investments |

184 |

1,774 |

|||||

|

Other, net |

11 |

14 |

|||||

|

Net cash used in investing activities |

(1,110) |

(760) |

|||||

|

Cash Flows from Financing Activities: |

|||||||

|

Proceeds from issuance of debt, net of discounts and fees |

11,116 |

4,371 |

|||||

|

Proceeds from equity issuance |

532 |

1,135 |

|||||

|

Payments of long-term debt, finance leases and other financing liabilities |

(4,072) |

(564) |

|||||

|

Repurchases of common stock |

— |

(353) |

|||||

|

Other, net |

(22) |

(18) |

|||||

|

Net cash provided by financing activities |

7,554 |

4,571 |

|||||

|

Net increase in cash, cash equivalents and restricted cash |

9,566 |

3,744 |

|||||

|

Cash, cash equivalents and restricted cash at beginning of the period |

11,742 |

2,868 |

|||||

|

Cash, cash equivalents and restricted cash at end of the period |

$ |

21,308 |

$ |

6,612 |

|||

|

Investing and Financing Activities Not Affecting Cash: |

|||||||

|

Property and equipment acquired through the issuance of debt, finance leases and other |

$ |

761 |

$ |

626 |

|||

|

Lease modifications and lease conversions |

59 |

470 |

|||||

|

Right-of-use assets acquired through operating leases |

214 |

48 |

|||||

|

Notes receivable and warrants received for entering into agreements |

139 |

— |

|||||

|

UNITED AIRLINES HOLDINGS, INC. NOTES (UNAUDITED) |

||||||||||||||||

|

Special charges (credits) and unrealized (gains) and losses on investments, net include the following: |

||||||||||||||||

|

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

|

(In millions) |

2021 |

2020 |

2021 |

2020 |

||||||||||||

|

Operating: |

||||||||||||||||

|

CARES Act grant |

$ |

(1,079) |

$ |

(1,589) |

$ |

(2,889) |

$ |

(1,589) |

||||||||

|

Impairment of assets |

59 |

80 |

59 |

130 |

||||||||||||

|

Severance and benefit costs |

11 |

63 |

428 |

63 |

||||||||||||

|

(Gains) losses on sale of assets and other special charges |

61 |

(3) |

77 |

10 |

||||||||||||

|

Total operating special charges (credits) |

(948) |

(1,449) |

(2,325) |

(1,386) |

||||||||||||

|

Nonoperating unrealized (gains) losses on investments, net |

(147) |

(9) |

(125) |

310 |

||||||||||||

|

Nonoperating debt extinguishment and modification fees |

62 |

— |

62 |

— |

||||||||||||

|

Nonoperating special termination benefits and settlement losses |

— |

231 |

46 |

231 |

||||||||||||

|

Nonoperating credit loss on BRW Aviation Holding LLC and BRW Aviation LLC (“BRW”) term loan and |

— |

— |

— |

697 |

||||||||||||

|

Total nonoperating special charges and unrealized (gains) losses on investments, net |

(85) |

222 |

(17) |

1,238 |

||||||||||||

|

Total operating and nonoperating special charges (credits) and unrealized (gains) losses on investments, net |

(1,033) |

(1,227) |

(2,342) |

(148) |

||||||||||||

|

Income tax expense, net of valuation allowance |

203 |

241 |

494 |

227 |

||||||||||||

|

Total operating and non-operating special charges (credits) and unrealized (gains) losses on |

$ |

(830) |

$ |

(986) |

$ |

(1,848) |

$ |

79 |

||||||||

CARES Act grant: During the six months ended June 30, 2021, the company received approximately $5.8 billion in funding pursuant to certain Payroll Support Programs under the CARES Act (“PSP2” and “PSP3”) which included an approximately $1.7 billion unsecured loan. The company recorded $1.1 billion and $2.9 billion as grant income during the three and six months ended June 30, 2021, respectively. The company also recorded $52 million and $99 million for the related warrants issued to United States Treasury (“Treasury”) as part of the agreements related to PSP2 and PSP3, within stockholders’ equity, as an offset to the grant income in the three and six months ended June 30, 2021, respectively. The company deferred recognition of $1.1 billion of the funds received under the PSP3 program as of June 30, 2021 as the funds can only be used for the payment of eligible salaries, wages and benefits. The company expects the remainder of the PSP3 funds will be recognized as income in the third quarter of 2021.

During the three and six months ended June 30, 2020, the company received approximately $4.5 billion in funding pursuant to a separate Payroll Support Program under the CARES Act, which consisted of a $3.2 billion grant and a $1.3 billion unsecured loan. The company recognized $1.6 billion of the grant as a credit to Special charges (credit) and $57 million in warrants issued to Treasury, within stockholder’s equity, as an offset to the grant income.

Impairment of assets: During the three and six months ended June 30, 2021, the company recorded $59 million of impairments primarily related to 64 Embraer EMB 145LR aircraft and related engines that United retired from its regional aircraft fleet.

During the three and six months ended June 30, 2020, the company recorded impairment charges of $80 million and $130 million, respectively, for its China routes, which was primarily caused by the COVID-19 pandemic and the company’s subsequent suspension of flights to China.

Severance and benefit costs: During the three and six months ended June 30, 2021, the company recorded charges of $11 million and $428 million, respectively, related to pay continuation and benefits-related costs provided to employees who chose to voluntarily separate from the company. The company offered, based on employee group, age and completed years of service, pay continuation, health care coverage, and travel benefits. Approximately 4,500 employees elected to voluntarily separate from the company.

During the three and six months ended June 30, 2020, the company recorded $63 million related to pay continuation and benefits provided to employees who chose to voluntarily separate from the company.

(Gains) losses on sale of assets and other special charges: During the three and six months ended June 30, 2021, the company recorded charges of $61 million and $77 million, respectively, primarily related to incentives for certain of its front-line employees to receive a COVID-19 vaccination and the termination of the lease associated with three floors of its headquarters at the Willis Tower in Chicago in the first quarter of 2021.

Nonoperating unrealized gains and losses on investments, net: During the three and six months ended June 30, 2021, the company recorded $90 million of gains related to its equity investments and warrants in the equity of Clear Secure, Inc. (formerly, Alclear, Inc.). Clear Secure, Inc. undertook its initial public stock offering in June 2021. Also during the three and six months ended June 30, 2021, the company recorded gains of $57 million and $35 million, respectively, primarily for the change in the market value of its investment in Azul Linhas Aéreas Brasileiras S.A. (“Azul”).

During the three and six months ended June 30, 2020, the company recorded gains of $9 million and losses of $310 million, respectively. The losses in the six months ended June 30, 2020 were primarily due to a $284 million decrease in the market value of the company’s investment in Azul and a $24 million decrease in the fair value of the Avianca Holdings S.A. (“AVH”) share call options, AVH share appreciation rights and AVH share-based upside sharing agreement.

Nonoperating debt extinguishment and modification fees: On April 21, 2021, United issued, through a private offering to eligible purchasers, $4.0 billion in aggregate principal amount of two series of notes, consisting of $2.0 billion in aggregate principal amount of 4.375% senior secured notes due 2026 and $2.0 billion in aggregate principal amount of 4.625% senior secured notes due 2029. United used the net proceeds from the offering of the notes and borrowings under a new $5.0 billion term loan facility to repay in full the $1.4 billion aggregate principal amount outstanding under the then-existing term loan facility included in the Amended and Restated Credit and Guaranty Agreement, dated as of March 29, 2017 (the “Existing Credit Agreement”), the $1.0 billion aggregate principal amount outstanding under the revolving credit facility included in the Existing Credit Agreement and the $520 million aggregate principal amount outstanding under the CARES Act loan. During the three and six months ended June 30, 2021, the company recorded $62 million of charges for fees and discounts related to the issuance of new debt and the prepayment of these debt agreements.

Nonoperating special termination benefits and settlement losses: During the six months ended June 30, 2021, as part of a first quarter voluntary separation program, the company recorded $46 million of special termination benefits in the form of additional subsidies for retiree medical costs for certain U.S.-based front-line employees. The subsidies were in the form of a one-time contribution into the employee’s Retiree Health Account of $125,000 for full-time employees and $75,000 for part-time employees.

During the three and six months ended June 30, 2020, the company recorded $231 million of settlement losses related to the company’s primary defined benefit pension plans covering certain U.S. non-pilot employees, and special termination benefits offered under voluntary separation programs to certain U.S. based front-line employees participating in the non-pilot defined benefit pension plan and postretirement medical programs.

Nonoperating credit loss on BRW term loan and related guarantee: During the six months ended June 30, 2020, the company recorded a $697 million expected credit loss allowance for the company’s Term Loan Agreement (the “BRW Term Loan”), with, among others, BRW Aviation Holding LLC and BRW Aviation LLC, and the related guarantee. BRW’s equity and BRW’s holdings of AVH equity are secured as a pledge under the BRW Term Loan, which is currently in default.

Effective tax rate:

The company’s effective tax rates for the three and six months ended June 30, 2021 were 23.0% and 22.6%, respectively. The effective tax rates for the three and six months ended June 30, 2020 were 18.8% and 19.1%, respectively. The provision for income taxes is based on the estimated annual effective tax rate which represents a blend of federal, state and foreign taxes and includes the impact of certain nondeductible items. The effective tax rates for the three and six months ended June 30, 2021 were impacted by $74 million and $79 million, respectively, of valuation allowance related to unrealized capital losses and state attributes. The effective tax rates for the three and six months ended June 30, 2020 were impacted by $64 million and $130 million, respectively, of valuation allowance related to unrealized capital losses.

SOURCE United Airlines

For further information: United Airlines Worldwide Media Relations, 872.825.8640, media.relations@united.com